Have you ever wondered how closely inflation affects economic growth? Or even just the key factors that cause inflation? This article will develop your ideas and understanding of inflation and its implications on the economy; showing the significant challenges many countries face today, but mainly focusing on the UK. As well as highlighting the long-term and short-term impacts the national surge caused – especially on LICs (Low income countries.) The 2021 – 2023 inflation surge has given us great examples of what happens with an inflation crisis – causing a lack of economic growth.

What is inflation?

The general definition for inflation is where there is an increase in the price of goods and services within an economy – measured by the consumer price index. However, this is important as salaries and wages stay the same, meaning that the economy’s currency does not go as far as it previously did. Therefore impacting the power, influence of money over a period of time.

Inflation within the UK is measured by the Office of National Statistics. They document over 700 goods that people usually buy, small everyday items and big things – including holidays. The total price of that ‘basket’ tells us the total price level which is known as the consumer price index or CPI. To calculate the inflation rate we compare this ‘year’s’ basket to the last previous year.

If you’re wanting to find out what specific amounts of money in the past are worth in the present, you can do so by using the inflation calculator formula.

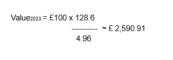

Using the formula may be hard to understand, but not to worry I will explain it simply. For example, if the CPI in 2023 was 128.6 and the CPI in 1955 was 4.96 and, you had £100 in 1955, this is what you would have to do:

This formula shows you that £100 in 1955 is equivalent to £ 2,590.91 in 2023.

The UKs economic climate

An economic climate is the general situation in a country that affects the wellbeing of individuals, firms and the government in areas such as output, price and employees. The economy is the state of a country in terms of how many goods/services a country is producing and consuming – the balance between imports and exports is very important. Economies that rely solely on imports have decreased levels of economic growth, especially during a recession or an inflation crisis; as well as facing economic vulnerability. An excess of imports can add inflation to the country as imported goods are more expensive, compared to a country that utilizes or makes the goods needed – which would boost the economy. Due to the fact that a country that can produce their own products can export these goods for a premium. Compared to a country that heavily relies on imports, where there is more potential for economic vulnerability. With this accounted for, an excess of imports extensively impacts economic growth mainly within the job sector. Therefore further impacting the UKs economy due to employment being a massive growth factor with places like London a massive opportunity for different job markets to expand – like AI.

Reduced Purchasing Power

Firstly, reduced purchasing power is one of the most immediate effects on the economy which generally is the most common factor that consumers tend to see on a day to day basis. As prices rise, the same amount of money buys fewer goods and services. When consumers cut back on spending, it leads to a decrease in overall demand leaving excess supply that potentially could become deadstock if the economy goes into a slump. Consumer spending is a critical driver of economic growth and negatively impacts businesses that rely on consumers and have no other streams of income to keep it afloat. This is known as the “inflation tax,” which erodes employees’ real income tax as the purchasing power decreases. This unfortunately affects lower-income households as they spend a larger portion of their income on essentials like food, housing, and transportation – with little room for goods. Which can lead to many struggling families who have to depend on the government as an effect of inflation, to be able to afford basic necessities – this seriously affects their quality of life. For example, in the UK we have laws like the Welfare Reform Act and the Social Security Benefits to protect families and individuals so they can have access to financial support in times of need.

In economies where consumer spending contributes to a significant portion of GDP (gross domestic product), reduced purchasing power can lead to slower economic growth. For example, in the United States, consumer spending accounts for approximately 70% of GDP. Therefore, any reduction in consumer spending due to inflation will have a detrimental impact on economic growth, potentially affecting employment rates and the cost of living.

Uncertainty and Reduced consumer confidence

High inflation creates economic uncertainty. When prices are rising rapidly, it becomes difficult for consumers and businesses to make long-term plans. This uncertainty can lead to reduced confidence and more cautious behaviour: which means people are less likely to spend money, and are more likely to save and be frugal.

For consumers, uncertainty about future prices can lead to delayed spending. If people expect prices to continue rising, they may choose to save more and spend less, further reducing demand. For businesses, uncertainty can lead to delayed investment and hiring decisions. Companies may adopt a “wait and see” approach, holding off on new projects until the economic outlook becomes clearer. This cautious behaviour can slow down economic growth.

Because of this, workers may ask for more pay due to the increase of inflation to balance the gap of businesses prices vs income; this leads to loss of consumer confidence as their wages do not match the rate of inflation. They also will have less disposable income, equalling less purchasing power and less control of the market. Therefore, workers will ask for more pay to balance out the sharp increase in mortgages, food and any goods that are essential. Otherwise, they will face challenges in affording houses or could possibly face homelessness and a lower standard of living. A survey ran by the BBC in June 2022, they found out more than half (56%) of the 4,011 people asked have reportedly bought fewer groceries, as well as skipped meals to try to combat and survive the cost of living crisis.

Higher Interest Rates

Central banks, such as the Federal Reserve in the United States or the European Central Bank, often respond to high inflation by raising interest rates. Higher interest rates are intended to cool down the economy by making borrowing more expensive, thus reducing spending and investment. Which is why we saw a sharp increase in interest rates in 2021 due to the cost of living crisis, where interest rates skyrocketed. The UK government has announced several forms of assistance, but many charities argue that these measures are insufficient for those in greatest need, and there are warnings that prices may continue to rise. However, the UK and many other countries have not seen that much improvement.

While higher interest rates can help control inflation, they can also slow down economic growth. When borrowing costs rise, consumers are less likely to take out loans for big-ticket items like houses and cars. Similarly, businesses are less likely to finance new projects or expand operations. This reduction in borrowing can lead to slower economic growth. Consumers are more likely to save as periods with higher rate of interest are commonly the best time to try and save money, although during these times many people cannot afford to save due barely scraping by, and being forced to live a lower quality of life. Therefore many people risk being Financially unstable which has negative effects on economic growth, as it can lead to reduced investment and increased uncertainty.

Increased Costs for Businesses

Inflation also increases costs for businesses. The prices of raw materials, labour, and other fixed costs, squeezes profit margins. Businesses may respond by raising prices, which can lead to a vicious cycle of rising costs and prices – affecting the cost of living more. As businesses match their prices with inflation, however salaries remain the same. When businesses do this, it harshly affects consumer spending – especially when there is a rise of unemployment due to the economic climate. Therefore, potentially leading to “cost-push inflation,” which is particularly damaging to economic growth. Businesses tend to raise and lower their prices depending on how well the economy is doing. The business cycle is a good example of this, as it represents the fluctuations of the economy – Boom, recession, slump and recovery.

Higher costs can lead to reduced business investment. When businesses face higher input costs, they may delay or cancel plans for expansion, hiring, and research and development. This reduction in investment can slow down productivity growth and innovation, which are key factors of long-term economic growth. This also can affect unemployment rates as businesses cannot afford to keep or employ employees, adversely affecting the economic performance.

Although affecting big businesses, inflation can make or break smaller businesses, harshly impacting small family-owned businesses due to less consumer spending as a result of lower disposable income, affecting small business owners on a microeconomic scale. This has adverse effects on the economy as businesses -even small ones – have a massive impact on the economy. They enhance, modify, and develop products and services that cater to the needs and desires of society. Which provides jobs, income and tax revenue. Without businesses, an economy would suffer severely. For example a 2019 report from the U.S. Small Business Administration found that small businesses generated 44% of all economic activity in the country – almost half!

Global Supply Chain Disruptions

The current inflation crisis is exacerbated by global supply chain disruptions. The COVID-19 pandemic has caused significant disruptions to global supply chains, leading to shortages of goods and higher prices. These disruptions have been further compounded by geopolitical tensions, such as the conflict in Ukraine, which has affected the supply of key commodities like oil and wheat.

Supply chain disruptions can lead to higher costs for businesses and consumers, further fuelling inflation. They can also lead to reduced economic growth, as businesses face difficulties in sourcing inputs and meeting demand. For example, the automotive industry has been significantly affected by shortages of semiconductors, leading to reduced production and higher prices for cars. Overall, the crisis has had a detrimental effect on the UKs economy – micro and macro.

In conclusion, the current worldwide inflation crisis presents significant challenges to economic growth: in the short term and the long term. The worldwide inflation crisis significantly impacts the UK’s economic growth by increasing the cost of living, which reduces consumer spending—a key driver of the economy. Businesses face higher operating costs due to rising prices for raw materials and energy, leading to lower profit margins and reduced investment. The Bank of England may raise interest rates to control inflation, increasing borrowing costs and slowing economic activity. Wage pressures can further strain businesses, while investment uncertainty deters both domestic and foreign investors. Additionally, inflation escalates government spending costs, potentially leading to cuts or higher taxes, all of which hamper economic growth.

Reduced purchasing power and increased costs for goods and services strain both consumers and businesses. As a result, central banks and governments must carefully navigate monetary and fiscal policies to stabilize prices without stifling economic recovery. Addressing these issues requires coordinated global efforts to ensure sustainable growth and mitigate the adverse effects of inflation on various economies. Without economic growth, unemployment rates rise, businesses struggle to expand or even maintain costs, as well as hindering any growth within the country. There are a few ways of tackling the crisis within the UK, one of which could be energy price controls, or encouraging domestic production.

Sources

©Inflation Tool (2024) GBP Inflation Calculator – British Pound [Online] Available at: GBP Inflation Calculator – British Pound (1955-2024) (inflationtool.com) (Assessed 31st June 2024)

Unable to find author (2024) Cost of Living Crisis: What is it and when will it end? [online] Available at: Cost of Living Crisis: What is it and when will it end? – BBC Newsround (Assessed 31st June 2024)

Email – [email protected]

Faye Walton – 31/07/24

this was actually really insightful 🙂